Expert Regulatory and Compliance Services for Business Growth

- Strengthening Governance,

- Reducing Risk,

- Ensuring Regulator-Ready Compliance

Compliance Challenges Made Simple with Our Expert Solutions

We help leadership teams cut through regulatory noise and transform compliance into a structured, business aligned capability that protects growth, reputation, and stakeholder trust.

Framework-Aligned Assurance

Our approach aligns your controls with globally recognized frameworks and regional regulations, ensuring audit readiness, consistency, and defensible compliance across operations

Reduced Risk, Reduced Effort

By simplifying policies, streamlining controls, and eliminating duplication, we reduce compliance overhead while strengthening risk management and operational resilience.

Don’t Let Compliance Risks Slow Your Business Down

From regulations to frameworks and audits, we handle the complexity so you can focus on scaling your business with confidence. Stay compliant, stay protected, and stay ahead.

Why Compliance & Regulatory Alignment Matters

Modern businesses must demonstrate strong governance, implement regulator-ready documentation, and follow established compliance frameworks to avoid penalties, operational disruptions, or reputational damage. Across Africa and the UAE, regulators are strengthening standards around

- Avoid heavy regulatory penalties, fines, and legal consequences by staying fully aligned with regional compliance requirements.

- Strengthen governance with clear processes, defined accountability, and efficient internal control mechanisms.

- Enable smooth cross-border operations by managing multi-jurisdictional compliance across UAE and African regions.

- Build customer and stakeholder trust by meeting data protection, AML/KYC, and ethical governance expectations.

- Stay ahead of evolving laws and emerging risks with a future-ready compliance structure.

- Reduce operational risk and improve organizational stability through continuous compliance oversight

- Protect business reputation and ensure long-term credibility with strong, proactive compliance practices

Our Core Compliance and Regulatory Services

Regulatory Compliance

Our experts map applicable regulations like POPIA, NDPR, GDPR, DPA, and Data Office guidelines to your business environment, identify compliance gaps, and implement structured GRC controls.

Compliance Audit & Reporting

We conduct comprehensive audits to assess your organization’s adherence to regulatory, privacy, and security requirements.

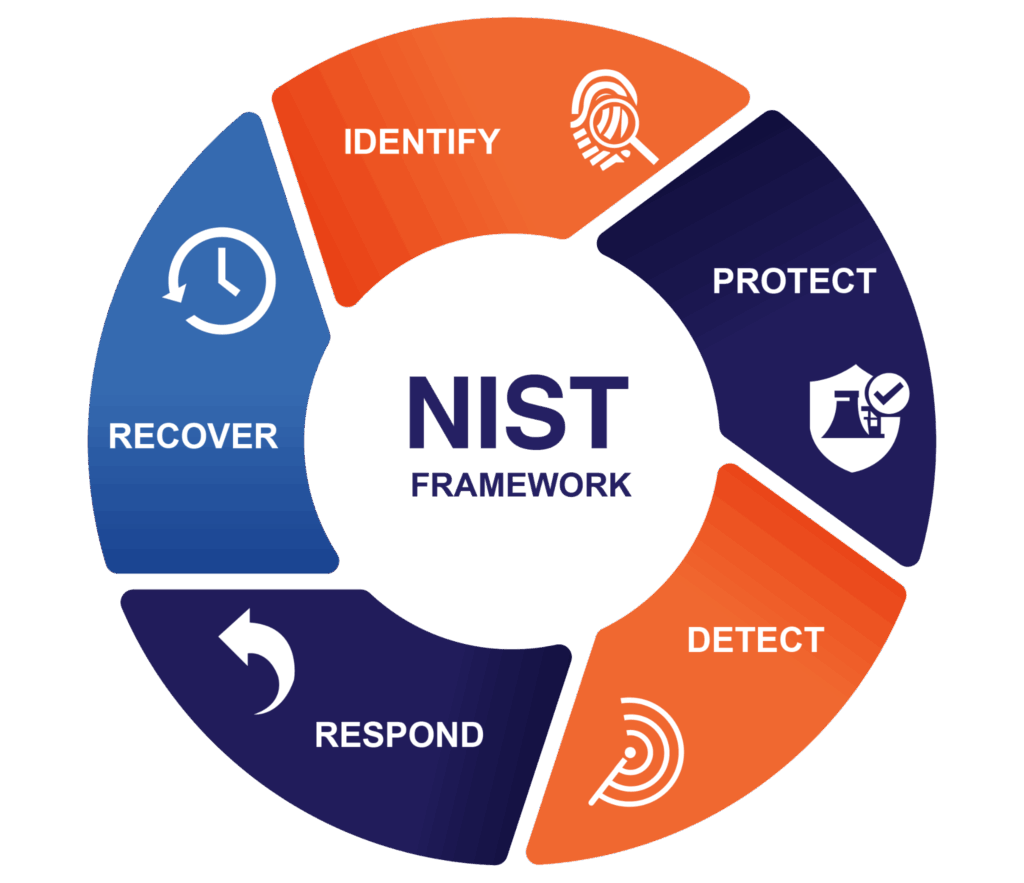

Advisory for Core Frameworks

Our approach includes developing policies, implementing controls, guiding your teams through compliance activities, and preparing your business for certification or audit readiness.

Compliance Documentation

We develop structured, regulator-ready documentation such as policies, SOPs, risk registers, DPIAs/PIAs, compliance reports, and corrective action plans.

Managed Compliance

Our managed compliance services offer continuous, year-round support for regulations like NDPR, POPIA, Kenya DPA, UAE Data Protection Laws, PCI DSS, and financial sector guidelines.

Compliance Training

We deliver tailored training programs covering data protection laws, ISO 27001 controls, cybersecurity hygiene, and sector-specific regulatory requirements.

Our Core Service Matrix

Managed Compliance for Multi-Framework Environments

Continuous Compliance Monitoring

Compliance Frameworks We Support

The Strategic Advantages We Bring to Your Organization

Faster Time-to-Compliance

Our experienced team accelerates your compliance journey.

Clear Governance & Strong Internal Controls

We establish structure, accountability, and clear workflows.

Increased Investor & Stakeholder Confidence

Strong compliance boosts credibility and increases valuation.

Prevent Fines & Legal Exposure

Avoid costly mistakes, breaches, or non-compliance issues.

End-to-End Regulatory Support

We provide continuous monitoring, updates, reporting, and advisory.

Empowered Teams Through Training

Your staff understands their compliance roles clearly.

Our Compliance and Regulatory Alignment Process

Regulatory Mapping & Assessment

We identify all applicable laws based on your business model, country, sector, and data flows.

Gap Analysis

We measure your current state against required regulations such as NDPR, POPIA, GDPR frameworks.

Implementation of Controls

We design and deploy governance, policies, SOPs, and frameworks.

Documentation & Audit Preparation

We prepare regulator-ready documents aligned with your industry.

Continuous Monitoring

Monthly compliance health checks and regular reporting ensure you stay compliant.

What Our Approach Includes

- Compliance advisory aligned with industry, size, and jurisdiction

- Risk assessment and compliance gap analysis

- Mapping regulatory requirements to business processes

- Alignment with frameworks such as PDPL, GDPR, POPIA, PCI DSS, and ISO 27001

- Governance, risk, and compliance (GRC) maturity modeling

- Policy documentation, SOP creation, and controlled implementation

- Continuous monitoring and compliance performance reporting

Protect Your Business. Reduce Risk. Stay 100% Compliant.

If you want to ensure regulatory alignment, build a future-ready compliance structure, and eliminate operational risks,

our experts are here to support you.

FAQs

What risks does my business face if it is not fully compliant?

Non-compliance can lead to heavy fines, legal actions, operational interruptions, and in severe cases, suspension of business activities. It also increases the risk of data breaches, customer mistrust, and long-term reputational damage. Maintaining compliance ensures stability, credibility, and safe business growth.

Do you provide compliance support for businesses operating in multiple regions?

Yes. We specialize in helping organizations manage compliance across diverse regulatory environments, especially those operating between the Middle East and African markets. Our multi-jurisdictional approach ensures your business remains aligned with regional and international standards.

How frequently should a compliance audit be conducted?

We recommend conducting a comprehensive compliance audit at least once every year. However, industries such as finance, healthcare, fintech, and digital services may require quarterly or semi-annual audits due to higher regulatory scrutiny.

Can you help us develop compliance policies, documentation, and reports?

Absolutely. We create all essential compliance documents—including policies, SOPs, risk assessments, DPIAs, and regulator-ready reports—tailored to your industry and legal obligations.

Do you offer outsourced compliance leadership?

Yes, Our Compliance Officer service provides continuous oversight, reporting, and guidance, offering full compliance leadership without the need for internal hiring.

How long does it take to achieve compliance readiness?

The timeline typically ranges from 30 to 90 days, depending on your current compliance maturity, sector requirements, and regulatory scope.